ROI CALCULATOR: WHAT'S STRATEGIC DECISION-MAKING COSTING YOU?

Most organizations never quantify what failed initiatives and poor execution actually cost. These losses are distributed across multiple budget lines—making them invisible to leadership despite their scale.

This calculator helps you quantify the financial impact using research-backed frameworks from PMI and McKinsey.

Time required: 10 minutes

You'll need: Basic portfolio data (initiatives launched, typical budgets, rough success rates)

THE FOUR COST CATEGORIES

1. FAILED INITIATIVES

Initiatives cancelled mid-execution or that delivered no meaningful value.

Your Calculation:

Initiatives that failed in past 2 years: [ ____ ] ÷ 2 = [ ____ ] per year

Average cost per failure: $[ ____ ]M

Annual cost: $____ M

Research benchmark: PMI found only 50% of strategic initiatives meet objectives European CEO. Organizations waste $135M per $1B invested in failed projects PMI.

Example: 10 initiatives over 2 years at $3M each, 40% failure rate = 4 failures = $6M annually

2. EXECUTION WASTE

Timeline delays, budget overruns, scope reductions, rework—even on initiatives that don't fail completely.

Your Calculation:

Annual strategic portfolio: $[ ____ ]M

Waste percentage (use 12% if unsure): [ ____ ]%

Annual cost: $____ M

Research benchmark: McKinsey found mismanaged execution costs companies up to 10% of annual revenue The Strategy Institute. PMI found nearly 15% of strategic initiative spending is wasted due to poor execution European CEO.

What this includes:

Timeline delays that push benefits to future quarters

Budget overruns from unforeseen complexity

Scope reductions that deliver less value than promised

Rework when teams build the wrong thing initially

Example: $50M portfolio × 12% = $6M annually

3. CAPABILITY GAPS & MISALIGNMENT

Funding initiatives your organization can't execute or that don't align with strategic priorities.

Your Calculation:

Initiatives per year: [ ____ ]

% encountering capability gaps (use 25% if unsure): [ ____ ]%

Average cost per gap: $[ ____ ]M

Annual cost: $____ M

Research benchmark: Research shows strategic misalignment wastes 60% of company resources In-parallel. PMI found 61% of firms struggle to bridge the strategy-execution gap European CEO.

What this includes:

Scaling company attempts enterprise approach without infrastructure

Teams commit to capabilities they don't have (contractors fix it later)

Cross-functional misalignment requiring mid-course corrections

Initiatives approved but not truly aligned with strategic priorities

Example: 10 initiatives × 25% with gaps × $2M per gap = $5M annually

4. OPPORTUNITY COST (Lost Revenue)

Revenue-generating initiatives that failed or launched late, missing market windows.

Your Calculation:

Revenue initiatives attempted (past 2 years): [ ____ ]

Average projected revenue per initiative: $[ ____ ]M

Average % of opportunity lost: [ ____ ]%

Annual cost: [ # ] ÷ 2 × [ revenue ] × [ % lost ] = $____ M

Research context: Failed strategic initiatives create missed market opportunities while competitors seize the initiative In-parallel. Beyond direct costs, delays and failures mean revenue you never generate and competitive positions you never establish.

What this includes:

Failed product launches (projected revenue never materializes)

Delayed market entry (competitor establishes position first)

Missed strategic windows (regulatory changes, market timing, technology shifts)

Example: 3 revenue initiatives over 2 years at $5M projected revenue each, 1 failed (100% loss), 1 delayed 9 months (60% loss) = $4M annually

ROI SCENARIOS

GreenlightIQ catches these failures during planning, before budgets are committed—by validating capabilities, extracting expert knowledge, surfacing conflicts, and prioritizing risks.

Annual Investment: $150K

What if you prevent 20-30% of these failures?

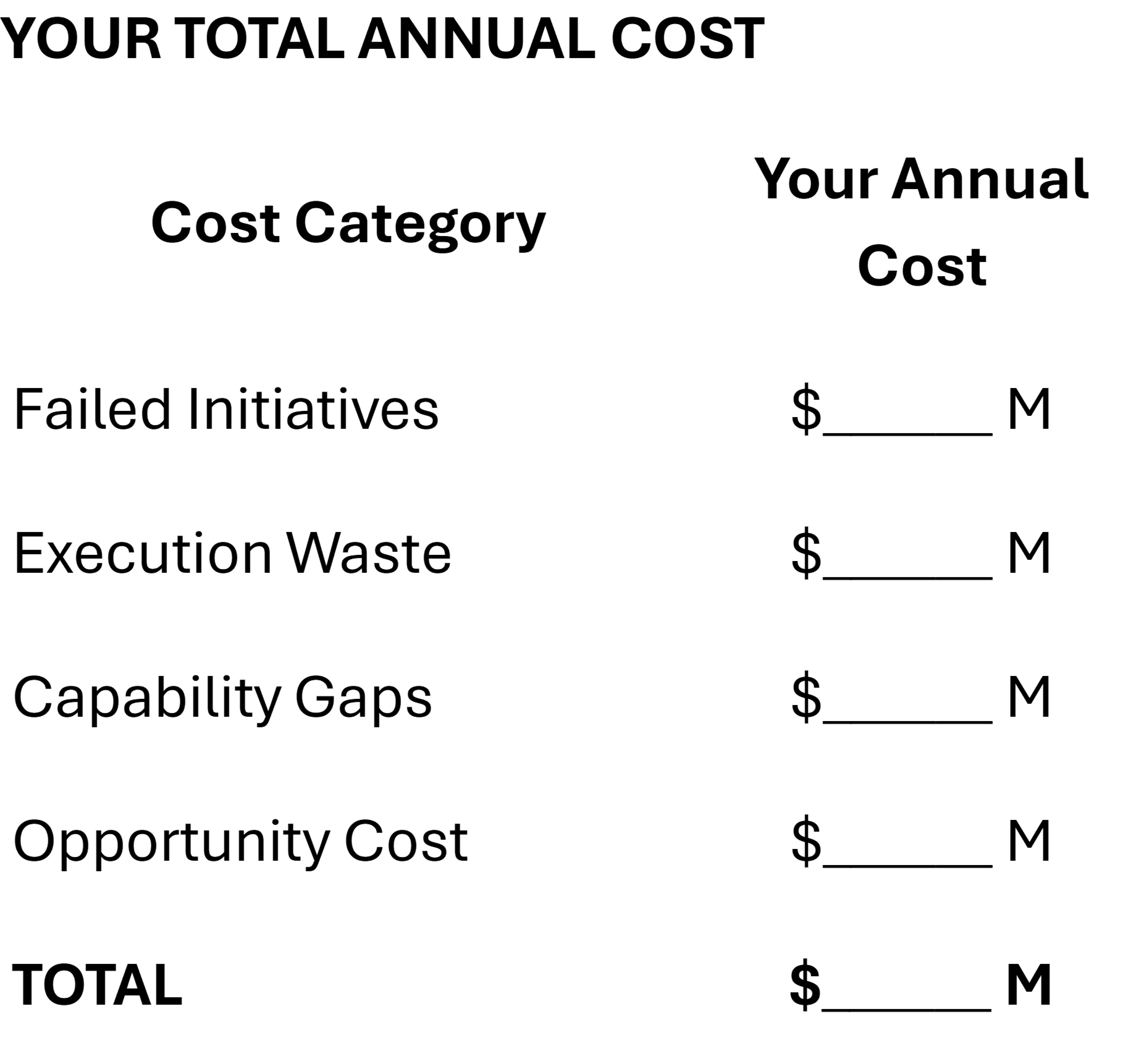

Your Total Cost: $____ M

20% Prevention: $____ M → ROI: ____X

25% Prevention: $____ M → ROI: ____X

30% Prevention: $____ M → ROI: ____X

Important: Actual results depend on how many initiatives you evaluate, quality of team inputs, and organizational commitment to acting on insights. GreenlightIQ doesn't guarantee success—it systematically identifies what could cause failure before you commit.

WORKED EXAMPLE: $500M COMPANY

Profile: $500M revenue, $50M strategic portfolio, 10 initiatives/year

Failed Initiatives: 2 per year × $3M = $6M

Execution Waste: $50M × 12% = $6M

Capability Gaps: 2.5 initiatives × $2M = $5M

Opportunity Cost: Revenue initiatives underperforming = $4M

Total Annual Cost: $21M

ROI Scenarios:

20% prevention: $4.2M saved → 28X ROI

25% prevention: $5.25M saved → 35X ROI

30% prevention: $6.3M saved → 42X ROI

PRESENTING TO THE BROADER TEAM

Key Messages:

1. The Scale: "Our annual cost of strategic decision-making failures is [X]M—[X]M— [X]M—[X]M over three years if the pattern continues."

2. The Validation: "PMI research shows 50% failure rates European CEO, McKinsey found execution problems cost up to 10% of revenue The Strategy Institute. Our numbers are conservative."

3. The Cause: "Most failures aren't bad luck—they're capability gaps, hidden assumptions, and misalignments that existed from day one but weren't surfaced before commitment."

4. The Solution: "Systematic validation before commitment. Even preventing 20% of failures delivers [X]X ROI."

5. The Alternative: "Without change, we'll experience similar losses next year. GreenlightIQ costs $150K. We can't afford NOT to."

NEXT STEPS

[Schedule 20-minute call] — Discuss your specific situation

[Apply as design partner] — Limited January 2026 spots

RESEARCH SOURCES

PMI (2013). "The High Cost of Low Performance." Pulse of the Profession. PMI

McKinsey & Company. Research on strategy execution costs. The Strategy Institute

PMI/Economist Intelligence Unit. "Why Good Strategies Fail." European CEO

In Parallel. "The Hidden Cost of Strategy Failure." In-parallel

Questions? steve@greenlightiq.com